Facts About Custom Private Equity Asset Managers Revealed

Wiki Article

The 8-Minute Rule for Custom Private Equity Asset Managers

You have actually probably become aware of the term personal equity (PE): purchasing firms that are not openly traded. Approximately $11. 7 trillion in possessions were taken care of by exclusive markets in 2022. PE companies look for chances to make returns that are far better than what can be attained in public equity markets. There might be a few points you don't comprehend regarding the sector.

Partners at PE companies increase funds and take care of the cash to generate positive returns for shareholders, generally with an financial investment perspective of between 4 and 7 years. Personal equity firms have a series of investment preferences. Some are rigorous financiers or easy investors wholly based on administration to grow the firm and generate returns.

Since the very best gravitate toward the bigger deals, the middle market is a substantially underserved market. There are much more sellers than there are extremely skilled and well-positioned money experts with extensive purchaser networks and sources to manage an offer. The returns of personal equity are normally seen after a few years.

Everything about Custom Private Equity Asset Managers

Flying below the radar of big multinational companies, a number of these tiny firms typically give higher-quality client service and/or niche products and solutions that are not being supplied by the large corporations (https://custom-private-equity-asset-managers-44593031.hubspotpagebuilder.com/custom-private-equity-asset-managers/unlocking-wealth-navigating-private-investment-opportunities-with-custom-private-equity-asset-managers). Such benefits draw in the interest of exclusive equity companies, as they possess the insights and smart to manipulate such chances and take the firm to the following degree

Personal equity Read Full Article financiers should have trusted, capable, and trustworthy management in area. Many managers at profile companies are provided equity and incentive payment structures that reward them for hitting their financial targets. Such placement of objectives is typically required before a bargain gets done. Exclusive equity opportunities are typically out of reach for people who can't spend numerous bucks, however they should not be.

There are guidelines, such as restrictions on the aggregate quantity of cash and on the number of non-accredited investors. The private equity service attracts some of the most effective and brightest in corporate America, consisting of top entertainers from Lot of money 500 firms and elite administration consulting firms. Law practice can also be recruiting premises for private equity works with, as audit and lawful skills are needed to total bargains, and deals are highly searched for. https://www.viki.com/users/cpequityamtx/about.

See This Report on Custom Private Equity Asset Managers

One more negative aspect is the absence of liquidity; when in a personal equity purchase, it is not easy to leave or sell. There is an absence of flexibility. Private equity additionally includes high costs. With funds under administration currently in the trillions, private equity firms have come to be appealing financial investment cars for wealthy individuals and organizations.

Currently that accessibility to private equity is opening up to more specific financiers, the untapped capacity is coming to be a truth. We'll begin with the major arguments for investing in personal equity: How and why exclusive equity returns have actually traditionally been higher than various other possessions on a number of levels, Just how consisting of private equity in a portfolio impacts the risk-return profile, by aiding to branch out against market and intermittent threat, Then, we will certainly detail some essential considerations and dangers for private equity financiers.

When it concerns presenting a new possession right into a profile, the a lot of basic consideration is the risk-return account of that asset. Historically, personal equity has actually shown returns comparable to that of Arising Market Equities and greater than all other conventional property classes. Its relatively low volatility combined with its high returns produces an engaging risk-return profile.

Excitement About Custom Private Equity Asset Managers

Exclusive equity fund quartiles have the widest array of returns throughout all different possession classes - as you can see listed below. Method: Internal price of return (IRR) spreads out computed for funds within vintage years independently and after that averaged out. Mean IRR was calculated bytaking the average of the typical IRR for funds within each vintage year.

The result of including private equity into a profile is - as always - reliant on the portfolio itself. A Pantheon research from 2015 recommended that consisting of personal equity in a profile of pure public equity can unlock 3.

On the various other hand, the finest exclusive equity firms have access to an even larger swimming pool of unknown opportunities that do not deal with the same examination, along with the resources to carry out due diligence on them and identify which are worth purchasing (Private Equity Firm in Texas). Investing at the first stage implies greater threat, yet for the companies that do succeed, the fund advantages from greater returns

The Only Guide for Custom Private Equity Asset Managers

Both public and personal equity fund supervisors commit to investing a percent of the fund however there stays a well-trodden concern with lining up interests for public equity fund management: the 'principal-agent problem'. When an investor (the 'major') hires a public fund supervisor to take control of their funding (as an 'representative') they entrust control to the manager while maintaining ownership of the possessions.

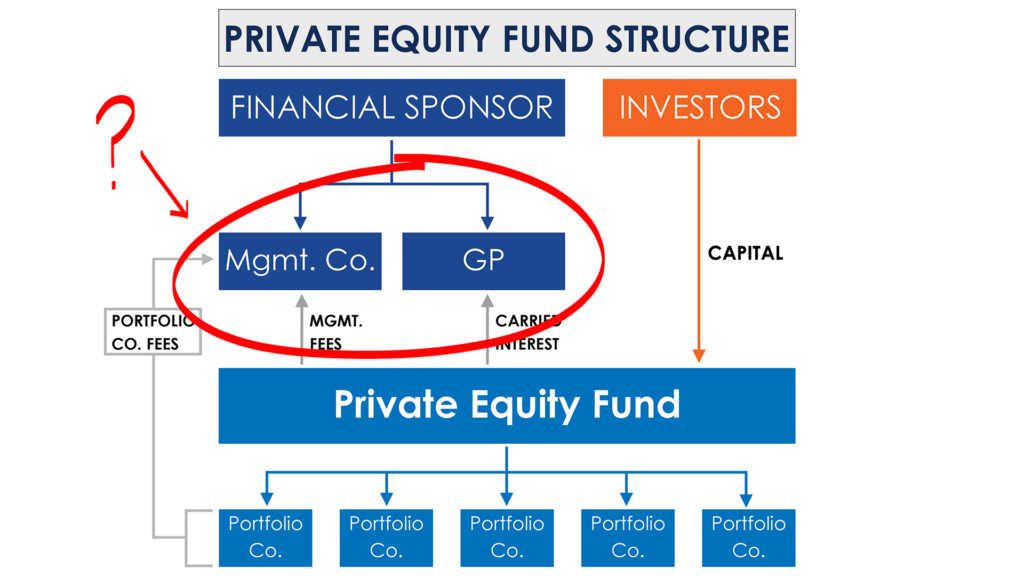

In the case of private equity, the General Companion doesn't just make a monitoring fee. Exclusive equity funds also reduce another type of principal-agent problem.

A public equity capitalist ultimately desires one thing - for the management to increase the supply rate and/or pay returns. The investor has little to no control over the choice. We revealed above the amount of personal equity strategies - specifically majority acquistions - take control of the running of the firm, making certain that the lasting worth of the firm comes initially, rising the roi over the life of the fund.

Report this wiki page